USDA Rural Development Loan – Tampa, FL

Do you want to purchase a home around Tampa, FL? If so, you may be pleased to learn that just outside the city limits of Tampa are eligible areas for the USDA rural development guaranteed home loan. The United States Department of Agriculture created the rural development loan (also known as the “USDA guaranteed loan” or “USDA rural housing loan”) to help promote home ownership for lower and middle income households. While these mortgages are known for assisting low income families to buy a home in a rural/suburban areas, USDA loans are actually available to moderate income households as well.

Advantages of the USDA Rural Development Guaranteed Loan Program:

- No Down Payment – What is possibly the single most well known benefit of a USDA loan is that they do not require any down payment.

- Finance Your Closing Costs – You can include the closing costs (loan origination, appraisal, upfront mortgage insurance, etc.) into the loan.

- Easy to Qualify – The requirements to be eligible are relatively easy compared to conventional loans. However, they are not available to high income households or in larger cities. The programs offered by the USDA often are the only mortgage loans available to applicants, which means it can make the difference of someone being able to own their own home or not.

- Low Mortgage Insurance – The monthly mortgage insurance on USDA loans, called the “guarantee fee” is lower than it is for other government-backed mortgages such as FHA loans. For USDA guaranteed loans, the monthly guarantee fee is 0.50% of the loan amount, and is adjusted each year as the loan balance decreases, therefore resulting in monthly mortgage payments being lowered annually.

- Fixed Interest Rates – All USDA home loans are provided on a fixed mortgage rate. This means that the interest rate stays the same and does not adjust or fluctuate like they do with an adjustable rate mortgage (ARM), which can cause sudden spikes in rates and payments.

- Higher Loan Limits – While other loans such as FHA, VA, and conventional loans have strict loan size limitations, there are no such loan limits placed on USDA loans. This means that if you qualify, you might be able to get a nicer home with a USDA loan than a FHA other other type of loan.

The above USDA loan requirements reflect any changes for 2018. The actual conditions that will be required for you to be approved for a USDA loan depend on your individual situation, such as your employment history, credit history, and debt-to-income ratios. You may need to meet additional requirements or provide additional documentation based on the review of your loan application.

Would You Like to Get Prequalified or Apply For a USDA Loan Now?

Click Here to Get Pre-Approved for a USDA Loan

2018 USDA Home Loan Requirements:

The USDA rural housing guaranteed loan program requires that you meet certain eligibility requirements related mostly to income and the property you want to buy. A great aspect of USDA loans is that the way you qualify is actually very different than it is with other home loans, such as conventional and FHA mortgages. While other programs require you to show more income, better credit, and more assets, the USDA is actually looking for those who may have a harder time getting a loan (you can still qualify with excellent credit, and even some assets, but not too much income).

The following criteria are the primary qualification requirements:

- Credit Requirements – A minimum credit score of 620 is required to get a USDA loan. Occasional exceptions are made, but this is the standard credit requirements for the guaranteed loan program. Some lenders are known to accept lower credit, but we have a minimum 620 requirement.

- Income Requirements – The maximum income allowed to finance a home with a USDA loan for any eligible area of Sarasota County, FL is limited to 115% of the median average income. This means your household income can not be more than 15% above the median income. The calculated income limits (median income x 115%) for the USDA guaranteed loan in Hillsborough County, FL are: For 1-4 people you can have a combined total annual household income of $75,650. For a household with 5-8 people the total household income can be as high as: $99,850. The number of persons includes you, your spouse, your children, and anyone else living in your home. Want to see more information or verify your income eligibility? The USDA has a very useful income eligibility tool which allows you to calculate your eligible income, make certain deductions, and then see if your income qualifies.

- Owner Occupied – No rental properties are allowed. You must occupy the home you want to buy with a USDA loan. Another requirement is that the home be either a single family residence, or a condo. Some other USDA lenders in Florida will allow mobile or manufactured, but we do not offer USDA loans for these property types.

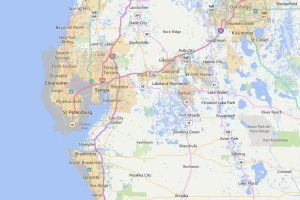

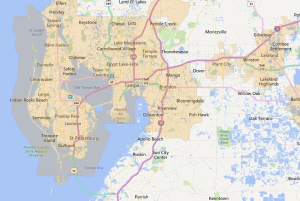

- Property Eligibility – USDA loans are intended for rural development and therefore exclusively available for homes in rural and select suburban areas. For this reason, cities and many populated towns are ineligible. Fortunately, there are several nearby cities, towns, and communities that are within an hour drive of the city of Tampa. This includes the following eligible areas: Apollo Beach, Crystal Springs, Darby, Dover, Land O’ Lakes, Memphis, Mulberry, Palmetto, Parrish, Ruskin, Sun City Center, Thonotosassa, Waterbury, Willow Oak, Wimauma, and Zephhyrhills. This is just to name some of the nearby eligible areas. You can look up what areas are eligible (or even search by address) using the USDA property eligibility search. This tool also allows you to view a map which shows what areas are and are not eligible for a USDA loan. You can also view screenshots below that outline ineligible areas of Hillsborough County. We can help you determine what areas are eligible or not if you need assistance.

If you want to buy a home in areas of Tampa that are not eligible for a USDA loan, we also offer other loan types such as FHA and conventional loans. Our FHA loans offer very competitive loan terms, including low down payments and low interest rates. To learn about all home loan options that exist for you, request a free pre-approval.

Would You Like to Get Prequalified or Apply For a USDA Loan Now?

Click Here to Get Pre-Approved for a USDA Loan

USDA Loan Frequently Asked Questions:

Do USDA loans require you to be a first time home buyer?

You do not have to be a first time home buyer. You can be a previous homeowner and still qualify for a USDA loan. If you currently own a home, you must sell it though, since USDA loans are only for a primary residence, and not a second home, investment property, or vacation home.

What refinancing options exist for USDA loans?

Once you have a USDA loan from the original purchase of your home, you may be able to streamline refinance on future loans. This is the equivalent of the FHA or VA streamline programs, and is an incredible refinance product. The USDA streamline refinance provides an easy way to quickly reduce your mortgage payment. It does not require a new appraisal (the one from your original purchase is used). You do not have to submit any documentation for your job or income, and no credit check is required. It is an easy and efficient way to lower your interest rate and mortgage payment.

If I was rejected for a USDA direct loan, can I apply for the USDA guaranteed loan?

Yes, you absolutely can. Many individuals or spouses who apply for the direct loan are turned down due to not meeting the various requirements, such as those related to income, can still qualify for the USDA guaranteed loan. The direct loan is for the lowest income borrowers, whereas the guaranteed loan allows a little more than the median income to be eligible.

What is the maximum amount that I can borrow?

There are no exact loan limits for USDA loans, as there are for other loan types such as FHA and conforming (conventional). The amount that you personally can borrow will be determined mostly based upon your debt-to-income ratio. This is calculated based on your monthly income and monthly debts. The max DTI ratio (unless you have “compensating factors” such as savings or great credit), is 43%. So if you make $5,000 in combined income, your total debts (mortgage payment and other debts such as auto loans and credit cards), must not exceed $2,150/month (which is 43% of the $5,000 example we are using here).

Can I use a USDA loan to purchase a duplex?

The only way you are allowed to purchase a duplex is if you buy only one of the two units. You are not allowed to buy both units of a duplex (or 3 units in a triplex, or 4 units in a fourplex). You can only buy one unit of the multi-unit property, or a single family residence (detached home, or in plain words, your typical single unit house).

Are USDA loans available to purchase a farm or agricultural property?

In spite of being backed by the United States Department of Agriculture, USDA loans are not available for agricultural properties or farms of any kind. It is common to assume they would be, but the USDA rural housing loans are only for residential properties.